utah state tax commission payment

Utah State Tax Commission. This will calculate penalties and interest for individual income or fiduciary taxes such as for late-filed or late-paid returns.

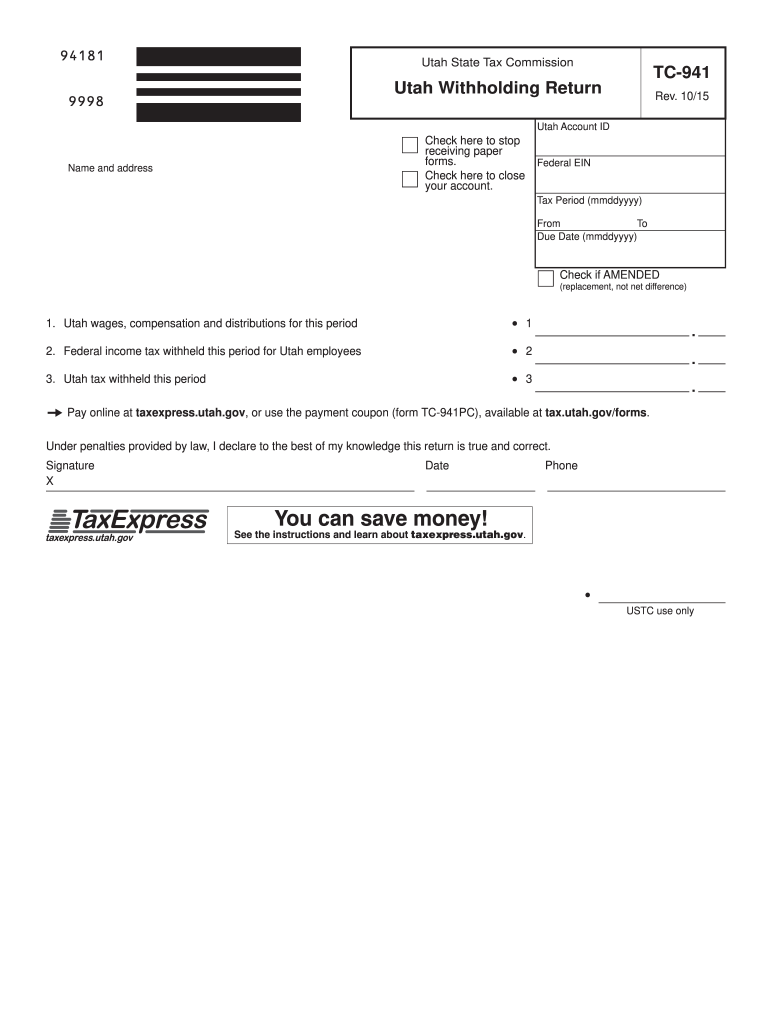

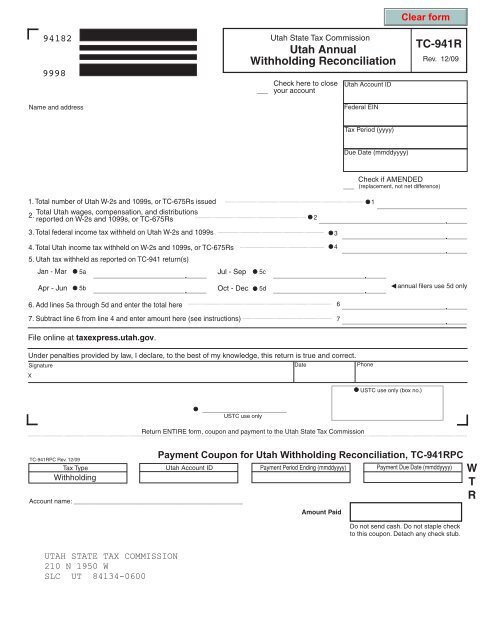

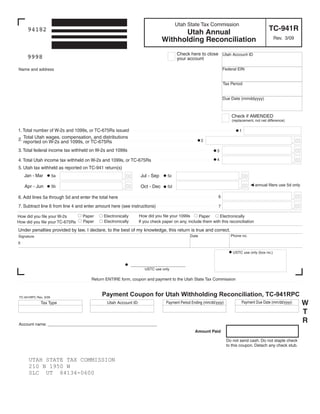

Tc 941r Utah State Tax Commission Utah Gov

Tax rates are also available online at Utah Sales Use Tax Rates or you can.

. 7703 or by sending in form TC-804B Business Tax. Please note that for security reasons Taxpayer Access Point is not available in. 210 N 1950 W.

This will calculate interest no penalties for most tax types such as. Property Tax Bills and Payments. 210 N 1950 W.

Official site of the Property Tax Division of the Utah. Please note that our offices will be closed November 24 and. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Salt Lake City UT 84134. If you are filing your return or paying any tax late you may owe penalties and interest.

TAX COMMISSION CONTACT INFORMATION. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0260.

Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266. You may request a pay plan for business taxes either online at taputahgov over the phone at 801-297-7703 800-662-4335 ext. Mail your payment coupon and Utah return to.

Please contact us at 801-297-7780 or dmvutahgov for more information. Please contact us at 801-297-2200 or taxmasterutahgov for more information. All Tax Commission offices will.

Use the Online Penalty and Interest Calculator to calculate your penalty and interest or follow the. If filing a paper return allow at least 90 days for your return to. File electronically using Taxpayer Access Point at.

You may now close this window. Mail your payment to 210 North 1950 West. TAX COMMISSION CONTACT INFORMATION.

Utah State Tax Commission. Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. Utah State Tax Commission 210 North 1950 West.

Other Ways To Pay. Make sure you put your name and account number on your payment. If you cannot pay the full amount you owe you can request a payment plan.

Make your check or money order payable to the Utah State Tax Commission. Questions about your property tax bill and payments are handled by your local county officials. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax.

You have been successfully logged out. All returns with payments. Go to taputahgov and choose Request Waiver Payment Plan E-Reminder.

This section discusses information regarding paying your Utah income taxes. You may also call the Tax. Salt Lake City UT 84134.

Utah Tax Officials Mailed Out 13 000 Incorrect Billing Notices

Senate Confirms John Valentine As Chair Of Utah State Tax Commission

Fillable Online Abc Utah Utah State Tax Commission 210 N 1950 W Salt Lake City Ut 84137 Fax Email Print Pdffiller

Utah State Tax Commission Boyer Company

Utah State Income Tax Return Information Prepare And Efile Now

Pub 45 Utah State Tax Commission Utah Gov

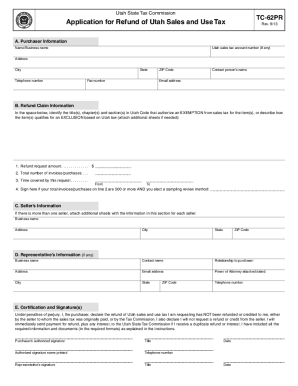

Sales Tax Refund Request Utah State Tax Commission Form Fill Out And Sign Printable Pdf Template Signnow

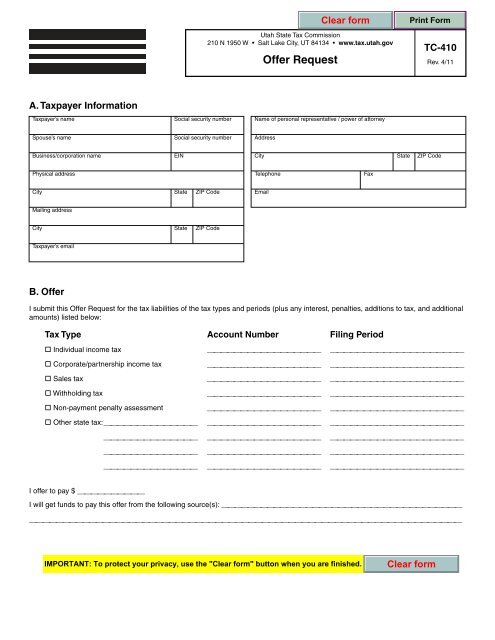

Tc 410 Utah Offer Request Utah State Tax Commission Utah Gov

Utah Tax Commission Reports 3 26b Increase In State Revenues Collected During 2021 Fiscal Year

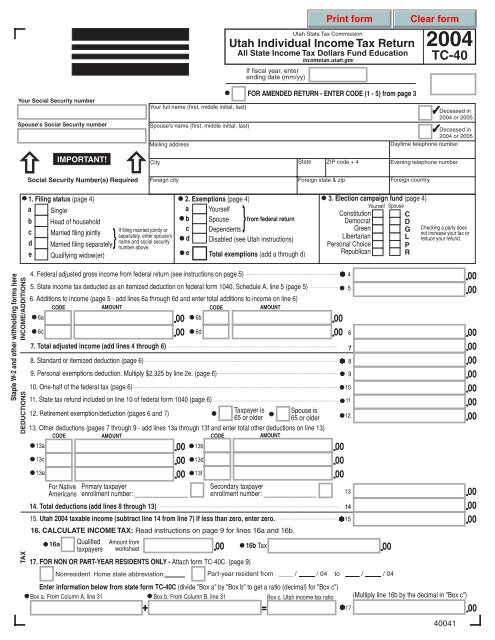

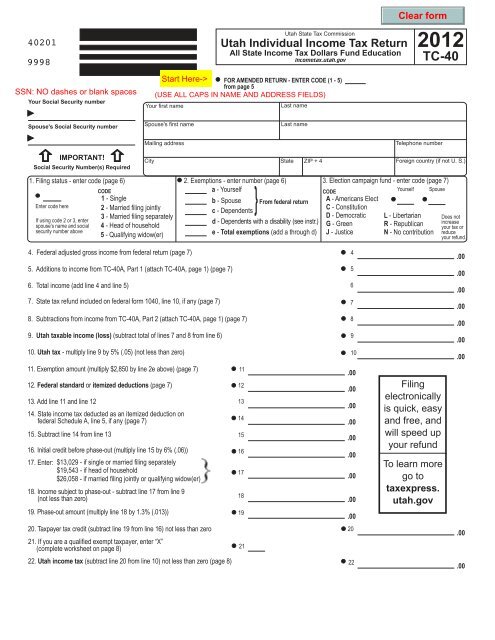

Utah Tax Forms And Instructions For 2021 Form Tc 40

Tax Utah Gov Forms Current Tc Tc 941r

Tc 40 Pdf Fill In Utah State Tax Commission Utah Gov

Pub 62 Utah State Tax Commission Utah Gov

Utah Sales Tax Small Business Guide Truic

Form Tc 40 Utah State Tax Commission Utah Gov